The sweet spot for when to take your Social Security benefits depends on many variables, including your age, the date of your birth, your spouse’s benefits, and whether you plan to work past age 62. Once you reach full retirement age, you will receive your full benefits no matter how much you earn. If you have not yet reached full retirement age and you claim your benefits, you will lose a percentage of that benefit for every month between your age and full retirement age. If you are working and receiving your benefits before full retirement, you also might have a portion of your benefits deducted if you earn above a certain limit.

On the other hand, once you reach retirement age, SS will recalculate your benefits to cover the money you lost when your benefit was reduced and you will have a higher benefit than previously expected. More than that, if you earn more than you did the year SS calculated your benefits, your benefits will likely be increased to reflect that year of higher earnings. So, there are a lot of factors to consider.

Retirement benefits by age

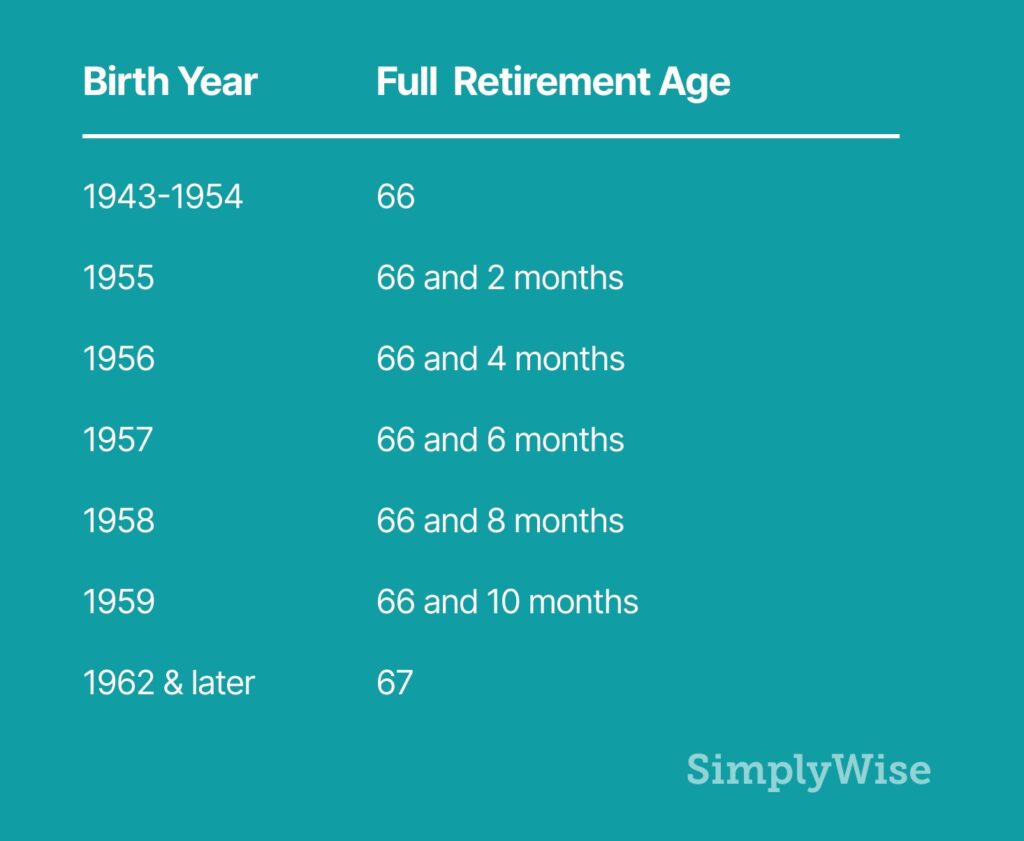

Over the generations, life expectancy has increased. This means people can work longer; it also means there are likely to be a lot more people drawing money from Social Security at the same time. To cope with this, Congress voted in 1983 to raise the federal retirement age gradually, so that the year at which a recipient is entitled to full benefits depends not only on the year the person claims benefits, but also on the year they were born. Beginning with 1955, Social Security adds two months for every birth year until full retirement age reaches 67 for people born in 1960 or later.

The following table shows the impact of year of birth on retirement age:

The decision on when to claim benefits is unique to your situation. If you file early, you get paid a smaller percentage of your benefit for more years. But once you’ve filed, you may not be able to change the amount you’re receiving. If you wait until 70 to retire, you will probably receive delayed retirement credits that will add more than 30 percent to your full benefit.

When you can receive benefits while working

You can work while you receive Social Security retirement or survivors’ benefits, but Social Security may reduce the benefit amount it pays you based on your wages made from a job–net profit if you’re self-employed–bonuses, commissions, and vacation pay. They do not count pensions, annuities, investment income, interest, or veterans or other government or military retirement benefits.

If you are below full retirement age for the full year, and you earn more than the 2020 earnings limit of $18,240, SS will deduct $1 in benefits for every $2 you earned above that limit. If you earn $2,000 over the limit, SS will take $1,000 from your monthly benefit amount.

In the year you reach full retirement age, SS adjusts the plan a little. The earnings limit for that year for 2020 is $48,600 and the administration then only deducts $1 for every $3 you earn above the limit. Once you reach full retirement age, you receive 100 percent of your benefit regardless of your earnings. Moreover, SS will give you credit for the months you did not receive a benefit because you were working and will increase your benefit amount.

Working while receiving benefits can be an advantage because the Social Security Administration evaluates the records for all working recipients each year. If your earnings are higher than the earnings of the year the administration used to compute your benefit, they will recalculate and raise your benefit amount retroactive to January, the year after you made the money.

Spousal benefits

If you are working and receiving spousal benefits, you are still subject to the earnings test mentioned above. Since a spouse can only claim up to half their spouse’s full benefit at full retirement, which does not include the money accrued for delaying retirement, working and building your own retirement benefit might be prudent, depending on how much your spouse has earned during their career.

Disability benefits

Social Security has specific programs for people who are receiving disability insurance benefits and also working.

The Trial Work Period program lets beneficiaries test their ability to work for at least nine months, during which time they will receive full benefits as long as they report their work. To count as a trial work month, total earnings must exceed $910, according to the 2020 scheme. If you work for yourself, a trial work month is one in which you either earn at least $910 or work more than 80 hours in your own business. You can use nine trial work months within a 60-month period. After the trial work period, you have 36 months during which you can work and still receive benefits for any month your earnings are below 2020 limits of $1,260 ($2,110 if you’re blind.) You do not need to apply again to receive a Social Security disability benefit during this period.

If your benefits stop because you have earned at least $1,260, you have five years to ask for benefits to restart if your condition prevents you from working. You will not have to file a new application or wait for benefits to start while we review your medical condition.

If your work requires you to pay for certain items or services because of your medical condition—such as using a special transit—we may deduct these expenses before calculating your monthly earnings.

Tax implications

If you file an individual federal return and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to half your benefits. If it’s above $34,000 you may have to pay income tax on up to 85 percent of your benefits. Combined income is your adjusted gross income minus your nontaxable interest, plus half of your SS benefits.

Those income limits rise for spouses filing a joint return with a combined income between $32,000 and $44,000. People who are married and filing separately will probably have to pay taxes.

Form SSA-1099, which comes in the mail in January or can be accessed on the website can help you determine whether your benefits are subject to tax.

How to maximize earning while working

The longer you work and earn an income, the greater your amount of benefit is likely to be in the end. Even if you have claimed your benefit and earn over the limit, your benefit will increase later, when you reach full retirement age.

There are few scenarios in which claiming SS early gives you a financial advantage. One possible exception is if you are eligible for survivor benefits and also your own benefit, you can claim the survivor benefit early—say at age 60–and postpone claiming your own benefit until retirement or later. If you received a full $1,000 a month benefit at age 66, it would total roughly $48,000 before you take your own benefit at age 70. But if you take it at age 60 and only receive 70 percent, that means you receive $700 per month for 10 years, totaling $84,000.

In another scenario, if you are 62 and have children under 18 in the home, they may be eligible for up to 50 percent of your benefit until they turn 18 or longer if they are disabled. In that case, for a period of time, you would be eligible for up to 125 percent of your benefit.

Retirement planning

Since waiting to claim your Social Security benefit may provide a lifetime benefit that is roughly 132 percent of your expected benefit, compared with 70 percent if you take it at age 62, those alternatives deserve a look. If you’re married, there are even more strategic elements to consider.

Some experts recommend tapping into your 401K or IRA rather than claiming Social Security early. Yes it will reduce your income in the short term, but may cause your lifetime income to increase significantly.

Another option is to take on a job that could possibly bump up your income so that it raises your benefit. At least it could help postpone your need to file early.

SSA has a Retirement Estimator that helps you figure out the best option for you. There are also plenty of online options including free Social Security benefits calculators to help you navigate the path forward.