You might be imagining retirement as a completely different life from your working years: enjoying the hobbies you never had enough time for; spending long, fun-filled days with your grandkids; traveling wherever and whenever the whim strikes.

But one aspect of your working years may follow you into retirement: taxes. Seniors are working at historic rates, so understanding the rules around taxation is more important than ever. Depending on how much you’ll earn during retirement and what state you live in, you may need to plan for the tax implications of your Social Security retirement income.

Is Social Security taxable?

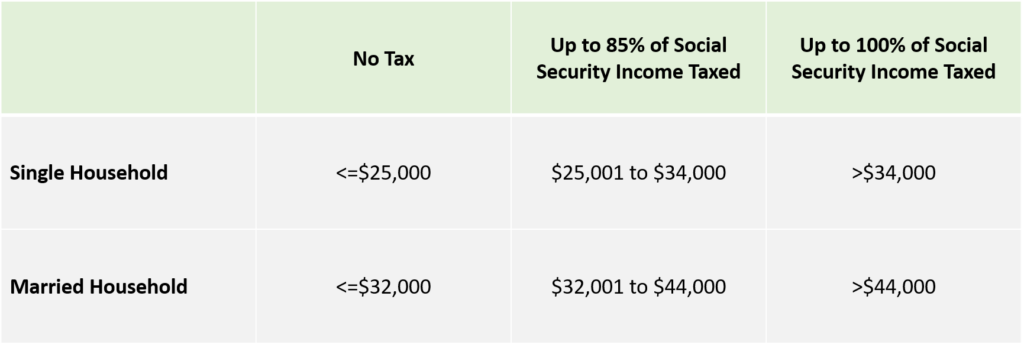

The short answer is that, yes, it is taxable. But only about 40% of people who receive Social Security taxes pay taxes on it, according to the IRS. That’s because Social Security is only taxable above certain income levels. For 2019, if you earn more than $25,000 as an individual or $32,000 as a couple, filing jointly, you’ll owe federal income taxes on your Social Security benefits, including retirement benefits, spousal benefits, survivor benefits and disability benefits.

This generally means that if Social Security is your only retirement income, you probably won’t owe taxes on it. But if you also have substantial income from wages, taxable pensions, interest or other sources, you likely will owe taxes on your Social Security payments.

Social Security tax rates

One piece of good news is that even if you have to pay taxes on your Social Security benefits, you won’t be paying on the full amount. Depending on your income, you’ll be taxed on a maximum of 85% of your Social Security benefits. Here’s how it works for 2019:

- Take your adjusted gross income (that means earnings, investment income and retirement plan withdrawals).

- Add your tax-exempt interest, such as interest from municipal bonds.

- Add half of your Social Security benefits.

- If the resulting number is less than $25,000 (as of 2019), you won’t owe taxes on your benefits.

- If the number is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits.

- If the number is more than $34,000, up to 85% of your benefits may be taxable.

If you’re married, filing jointly:

- Take your combined adjusted gross income (that means earnings, investment income and retirement plan withdrawals).

- Add your tax-exempt interest, such as interest from municipal bonds.

- Add half of your Social Security benefits (including spousal benefits).

- If the resulting number is less than $32,000 (as of 2019), you don’t have to pay taxes on your benefits.

- If the number is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits.

- If the number is more than $44,000, up to 85% of your benefits may be taxable.

As an example, you and your spouse received a total of $10,000 in Social Security payments during the year. You also have a pension that paid you $26,200 for the year, and you earned $700 in interest from a savings account.

Half of your Social Security payments is $5,000. Add in the pension and interest income, for a total of $31,900. Since the base amount for a married couple filing jointly is $32,000, you don’t owe taxes on your Social Security benefits.

How the tax is calculated

Social Security benefits are paid for through a tax on workers and their companies. Employees and employers each pay 6.2% of wages. Self-employed people pay 12.4%. For high salaries, only the first $132,900 of income is subject to the Social Security tax for 2019.

Once you begin receiving Social Security benefits, which you are allowed to start taking at age 62, they aren’t taxed differently depending on your age. However, if you’re still working while you’re collecting benefits, you’re much more likely to have to pay taxes on the benefits, since your income is likely higher.

To get an idea of how much you would pay in taxes, add half your Social Security benefits to your earnings. If the amount is above the $25,000 threshold for an individual or $32,000 as a joint filer, you would likely pay taxes. As we talked about above, the maximum amount of your benefits that can be taxed is 85%.

Let’s say you file your taxes as an individual, make $50,000 a year in income, and receive $1,500 a month in Social Security benefits. That means you receive $18,000 a year in Social Security benefits. You would pay taxes on 85% of that amount, or $15,300. The actual amount of taxes you pay depends on your individual federal income tax rate, which can range from 10% to 37%.

The size of your Social Security benefits will vary depending on when you retire and if you’re still working or not. For example, if you start collecting Social Security before you reach your full retirement age (age 66 to 67, depending on the year you were born), your Social Security benefits will be less, while they will be highest if you wait until age 70, when your monthly benefit is maxed out at 132% higher than at your full retirement age. Every year you wait to retire, your retirement credits go up 8%.

Later in this guide, we will share several strategies for minimizing the amount of taxes you might have to pay on Social Security benefits, but one common tip is to withdraw other retirement income, like from a 401(k) or IRA, before you start taking Social Security. You can begin making penalty-free withdrawals from retirement accounts at age 59.5. Withdrawing other income first could lower your overall income while you’re collecting Social Security, and so possibly lower the tax you owe on it.

An online calculator can help you determine how much you might have to pay in taxes on your benefits. The Motley Fool offers one, while the IRS has an interactive quiz.

Social Security & disability, Medicare

The rules for paying taxes on Social Security Disability Insurance benefits are the same for regular Social Security benefits: If you’re over the income limit, you’ll pay taxes on the benefits. This generally happens only when you have substantial income in addition to the disability benefits. The Social Security Administration estimates only a third of disability recipients pay taxes on their benefits. Benefits from the Supplemental Security Income program, for people with very limited resources who are disabled, blind or senior citizens, are never taxed.

Similarly, Medicare benefits under part A and B are not taxable. However, note that Medicare Part B premiums are usually withheld from Social Security benefits, rather than paid directly, and the Social Security benefits themselves could be subject to taxes.

Social Security taxes by state

Thirty-seven states and Washington, D.C. don’t have a local tax on Social Security in addition to federal income taxes. However, if you live in one of the following 13 states, you will pay a state tax on your Social Security income:

Colorado: Seniors age 65 and older aren’t taxed on the first $24,000 of retirement income, including Social Security. If you’re younger than 65 and receiving Social Security, Colorado lets you exclude $20,000 of retirement income from state income taxes.

Connecticut: Individuals with adjusted gross incomes of up to $75,000 don’t have to pay state taxes on Social Security benefits. The income limit for married couples is $100,000.

Kansas: Whether you’re filing individually or jointly, if your adjusted gross income is $75,000 or lower, you don’t have to pay state taxes on Social Security.

Minnesota: Under a somewhat complicated system, many filers can deduct some of their Social Security benefits from state taxation. The exact amount depends on your income and filing status. More information can be found here.

Missouri: If you’re single and earn less than $85,000 a year, or married and earn less than $100,000, your benefits won’t be taxed. If you earn more, you might receive a partial exemption.

Montana: Social Security benefits are taxed, though the taxable amount may be different than for federal purposes. A worksheet for computing how much is taxable can be found on the Montana income tax return.

Nebraska: You don’t have to pay taxes on your benefits if you earn $43,000 or less if you’re single, or $58,000 or less as a couple.

New Mexico: People 65 or older can deduct up to $8,000 of taxable retirement income, including Social Security, from their state income taxes. However, there are some income limitations.

North Dakota: A 2019 law now allows taxpayers to reduce their taxable income by the amount of their Social Security benefits that are subject to federal taxes. It applies to individuals with a federal adjusted gross income of $50,000 or less, or married couples earning $100,000 or less.

Rhode Island: Taxpayers can reduce their taxable income by the amount of their Social Security benefits that are taxable at the federal level. The income limits to benefit from this are $83,550 individuals and $104,450 for a married couple, for the 2018 tax year.

Utah: Social Security benefits are taxed like other income.

Vermont: if you’re single, your Social Security benefits are fully exempt from state taxes if your adjusted gross income is below $45,000, and partially exempt if your AGI is between $45,000 and $55,000. For those who are married, Social Security benefits are fully exempt if your AGI is less than $60,000 and partially exempt if your AGI is between $60,000 and $70,000.

West Virginia: Social Security benefits are currently taxed, but the tax will be phased out over the next several years. Starting with the 2020 tax year, the tax will be cut by 35%, then by 65% in the second year, and it will be fully eliminated by the third year. The tax break is available to married couples who earn $100,000 or less and singles who earn $50,000 or less.

Taxes and retirement strategies

If your non-Social Security income will be fairly high during retirement, you might want to know how to minimize or avoid paying Social Security taxes. Of course, keeping your Social Security benefits below the taxable level is one way, but not necessarily practical. It may be more realistic to try to minimize Social Security taxes instead. Here are several ways you might be able to do that:

- Before retirement, consider rolling over your IRA or 401(k) into Roth accounts. You’ll have to pay taxes at the time of the rollover, but you won’t have to when you withdraw the money during retirement, lowering your overall taxable income during retirement. You can even do this during retirement if the numbers work out in your favor.

- Look at your taxable and nontaxable income. Keep an eye on your income and see if it makes sense to try and lower it to keep you under a threshold for higher taxes.

- If you’re looking at annuities, one kind can offer a tax advantage when it comes to Social Security benefits planning. A qualified longevity annuity contract (QLAC) can be funded with an IRA or 401(k) and allows you to defer required withdraws until age 85, allowing you to time the withdraws for when they will take the smallest tax bite. You can spend up to $130,000, or 25% of your retirement account balance, on a QLAC.

- Consider donating your required minimum distribution (the amount the IRS requires you to take from a traditional retirement account every year, starting at age 70.5) to charity. This option, called a qualified charitable distribution, fulfills your distribution requirement but does not count toward your taxable income, thus giving you a chance to keep your taxable income low. You can give up to $100,000 annually in this way. The rules can be complicated though, so make sure you’re following the proper process, or consult a financial advisor.

- Retire to a state that doesn’t have a state income tax on Social Security, as discussed above.

- If you’re still working, you can contribute to an IRA or 401(k), thus reducing your taxable income and possibly lowering the tax on your Social Security benefits.

- If you’re selling your business, you should look into structuring the sale over several years, so that a large infusion of cash doesn’t push you into a higher tax rate on your Social Security benefits.

- If you will owe taxes on your Social Security benefits, set up an automatic withholding from your monthly payment rather than trying to remember to pay quarterly taxes on your benefits. Accidentally missing a payment could mean paying fines and interest in addition to the taxes.

Carefully arranging the order that you withdraw from your various retirement accounts can also lower your taxes. Your specific order may depend on your income, sources of retirement income and other factors, but here are some options to consider:

- Withdraw other retirement income, such as money from a 401(k) or IRA, before you start taking Social Security. You can begin making penalty-free withdrawals from retirement accounts at age 59.5, and you can begin taking Social Security from age 62 to 70. So withdrawing other income first might mean less overall income while you’re taking Social Security, and therefore less tax. (But don’t forget that you’ll owe taxes on the money you withdraw from your 401(k) or IRA.) This strategy provides another advantage: The longer you delay taking Social Security (up to age 70), the higher your benefits.

- Withdraw money from a Roth IRA or Roth 401(k) while taking Social Security benefits. Since you funded the Roth account with money that you already paid taxes on, everything in the account can be withdrawn tax-free. In addition, Roth accounts don’t have required minimum distributions, meaning more control over timing your retirement income, and more control over your Social Security taxes.

- For some people, you may end up paying less taxes on Social Security if you take your only required minimum distribution from your IRA or 401(k) each year, then take other money that you need from a Roth account.

What’s ahead

While some Social Security benefits can be taxed now, this wasn’t the case for the first few decades of the program. And the current taxation rules for Social Security benefits have only been in place since 1993. It’s important to remember that rules could change in the future, too.

When planning for your financial future, keep your retirement plan flexible enough that one tax change doesn’t throw everything off course. Staying informed yet adaptable will help you achieve the retirement you’ve been dreaming about.

Takeaways

Millions of Americans have paid into the Social Security system. Unfortunately, confusion is common, highlighted by misconceptions around spousal benefits, survivors benefits, child benefits, maximizing Social Security while working, maximizing benefits as a married couple, cost of living increases, how to apply and of course, taxes. Some of these mistakes can cost recipients upwards of $80,000.

Increasingly, online Social Security blogs and free calculators are emerging to help people avoid costly mistakes. Hopefully, with better education around the topic, Americans can plan with better ease and maximize what they’ve earned.