Investors over the age of 50 are constantly being pitched on the virtues of tax deferred annuities. In this post, we’ll look at some concrete numbers to figure out when tax deferral actually makes sense for many investors and savers. We’ll identify cases where it may make sense and cases where it doesn’t. Next time you hear about the virtues of tax deferral, you’ll have a sense for whether it’s right for you.

What is tax deferral exactly?

Tax deferred accounts allow investment gains to accumulate tax free until the investor withdraws money from the account. The most common types of tax deferred investments are Individual Retirement Accounts (IRAs) and deferred annuities.

Why might this be a good idea?

If your tax rate when you withdraw money is less than your tax rate now, you stand to save on taxes. Tax deferral doesn’t reduce your taxes; it just changes when you pay them and in some cases whether you pay ordinary income or capital gains. How much money you can lose/save with tax deferral depends on a number of factors: your rate of return, your tax rate now, and your tax rate during retirement and fees associated with a tax deferred vehicle.

Analyzing Tax Deferral for Bonds and Stocks

We’re going to analyze the effect of tax deferral on two types of instruments: a fixed income instrument and a stock ETF. Many fixed income instruments, such as CDs and bonds, tend to be tax inefficient, because they require you to pay taxes on any interest earned every year, whether or not you can withdraw that interest. Stock ETFs tend to be more tax efficient because their returns come from two sources: dividends and price appreciation. The dividends are taxed at ordinary income when they are paid out, while the price appreciation is taxed at the lower capital gains rate, assuming the ETF is held onto for more than a year.

Fixed Income Instruments

A certificate of deposit (CD), pays a holder a fixed rate of return each year and is not tax deferred. This means that the CD would pay you interest every year, but it is also taxed on a yearly basis, whether you withdraw the money or not. The second, a Multi-Year Guaranteed Annuity (MYGA), also pays a holder a fixed rate of return a year but is tax deferred. It is the insurance industries version of a CD. In our analysis, we are going to assume that both the CD and the MYGA pay the same rate of interest a year.

Scenario #1: Tax Rate Stays The Same

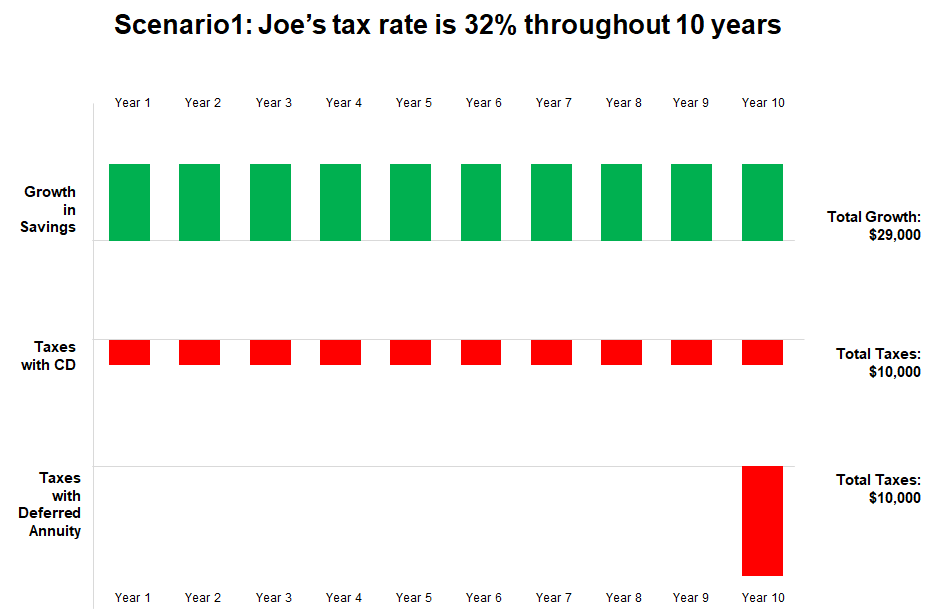

Joe is a 55 year old plastic surgeon. For the next 10 years he puts $100,000 into a CD and $100,000 into a MYGA that grows tax deferred. They both grow his money at the same yearly rate of 2.65%. Joe’s current tax rate is 32%, and we assume it stays at the same rate even after 10 years.

Let’s look at what would happen with both a CD and MYGA deferred annuity. During this 10 years, Joe’s tax rate remains constant at 32%. Over the course of those 10 years, his CD’s value would increase from $100,000 to about $130,000 (total growth of $30,000), with him paying roughly $10,000 in taxes over the course of his term. This would bring the net value of his CD to $120,000 at the end of the 10 years. Because Joe’s tax rate remained constant, the value of his MYGA deferred annuity would end up the same ($120,000) as his CD, with Joe paying the full $10,000 in taxes at the end of his term, rather than over the course of the full 10 years. In this scenario, both the CD and the annuity have the same value; the taxes are just paid differently. Result: Joe is indifferent about deferring taxes

Scenario #2: Tax Rate Drops in Retirement

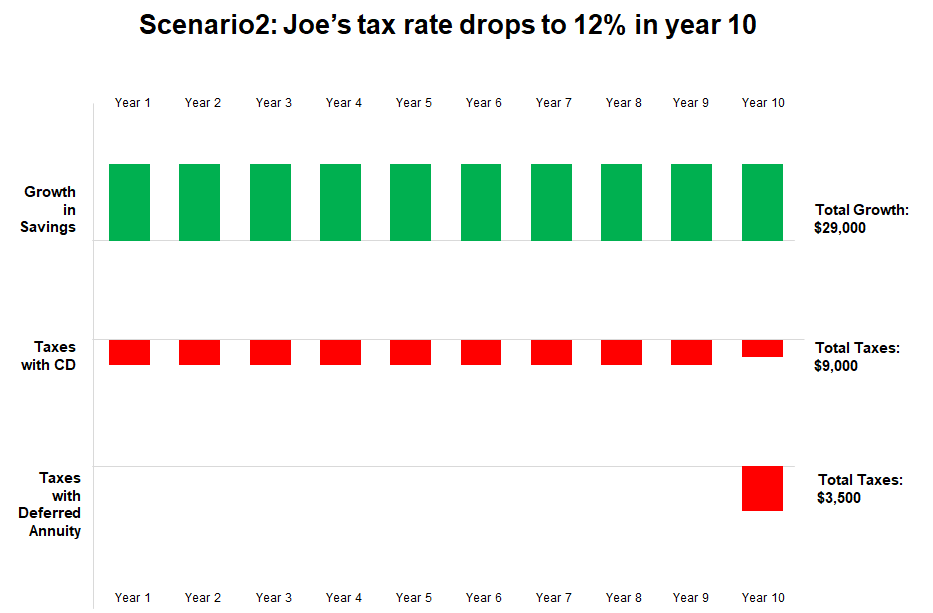

Scenario 2 is the same as scenario 1, except that we assume Joe’s tax rate drops to 12% in year 10 when he retires.

In this scenario, the MYGA deferred annuity would generate about $5,500 more than the CD. That’s because with the CD, Joe would have been paying a steady 32% in years 1-9, and 12% in year 10, totaling $9,000 in taxes over time. With his MYGA deferred annuity, he only pays taxes in year ten. This mean he will be taxed on the total growth of $100,000 to $129,000 at the 12% rate, resulting in a tax bill of $3,500. An annuity was useful here as it saved him $5,500. Result: Joe saves $5,500 by deferring taxes. Lets dig into this specific scenario a little bit more deeply. We see that Joe saves about $5,500 with a tax deferred instrument, but how does the magnitude of money saved change depending on what his tax rate is right now vs. what is will be during retirement?

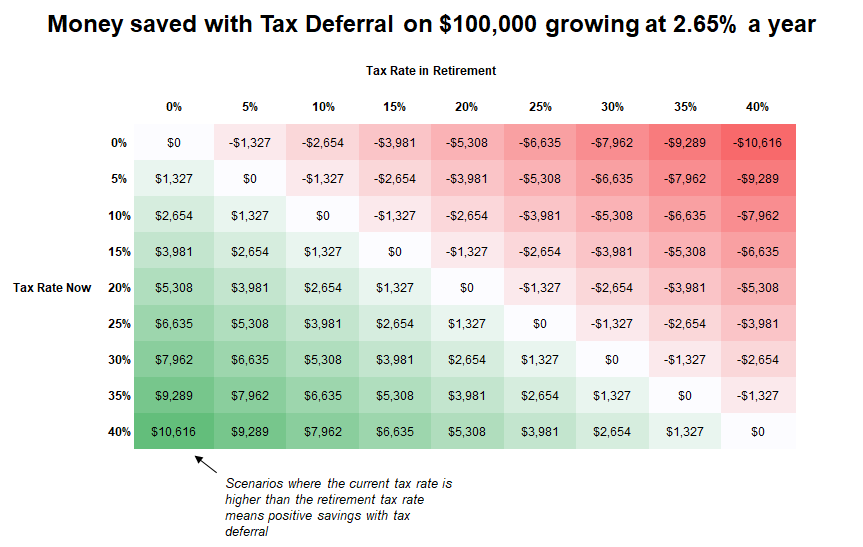

The table above shows how the amount of money Joe would have saved changes based on his current and retirement tax rate. Not surprisingly, if his current tax rate is 37% and his retirement tax rate is 10%, he stands to save the most ($7,166) through tax deferral. If his retirement tax rate is actually higher than his current tax rate, he stands to lose money with tax deferral (as seen in the red cells of the table). A key insight from the table above is that what matters is the difference between Joe’s current tax rate and his retirement tax rate. For some savers, this may be a meaningful amount of money saved; for others they may not care. Given current interest rates, you can use this rule of thumb to figure out if tax deferral on a fixed interest rate return is potentially meaningful for you.

Equities

Now, we are going to analyze the effects of tax deferral on holding equities. We will assume that Joe buys an SPY ETF in his brokerage account and holds it for 10 years. We will compare this to putting the money into a tax deferred variable annuity, specifically the Vanguard variable annuity. The Vanguard variable annuity has an annual cost of 0.52%, which is one of the cheapest variable annuities in the market today. We will analyze the tax consequences of the a scenario where the doctor’s tax rate stays the same and a case where his tax rate drops in retirement.

Scenario #1: Tax Rate Stays The Same

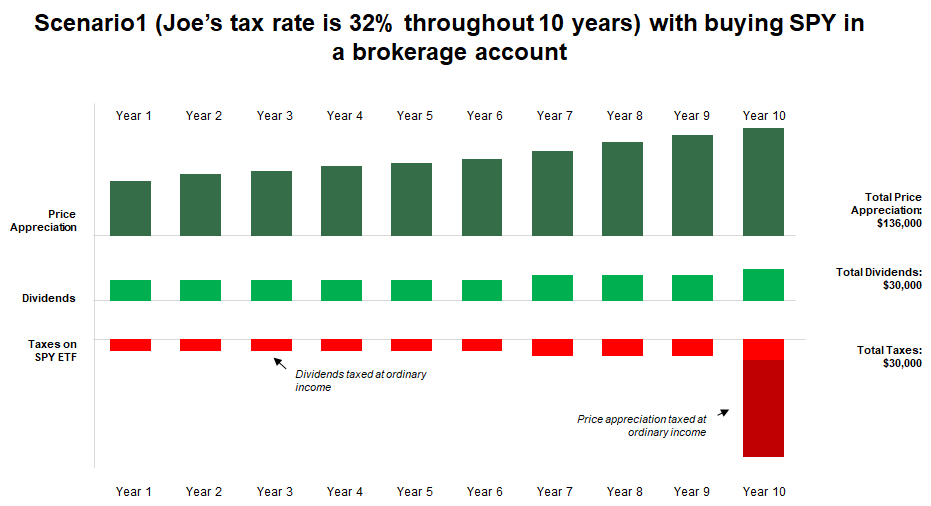

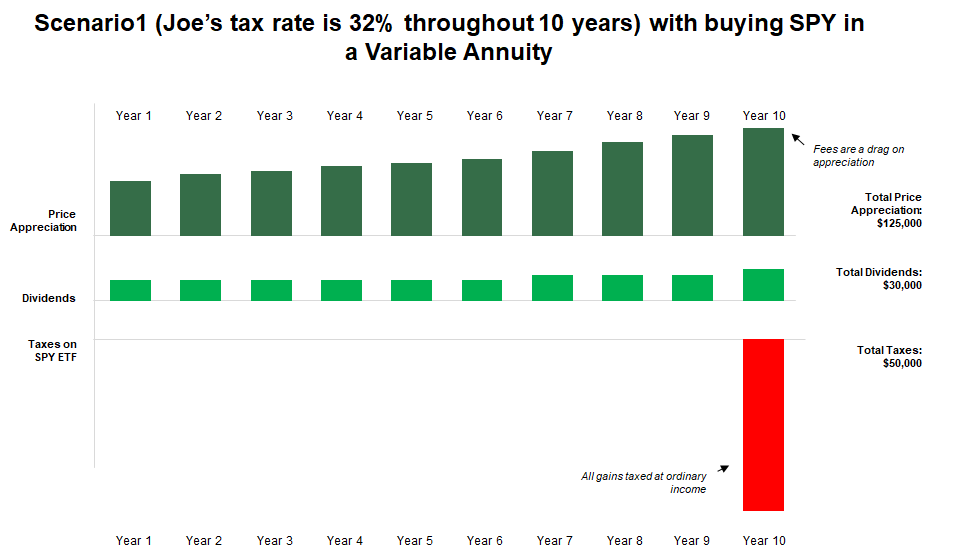

Joe is 55 years old. For the next 10 years he puts $100,000 into the SPY ETF and $100,000 into a Vanguard Variable Annuity (cost 0.52% a year) that holds SPY. We assume the price appreciation of the S&P 500 over this period is 9% a year, while the dividend yield is 2%. Joe’s current tax rate is 32%, and we assume it stays at the same rate even after 10 years. Let’s look at what Joe’s take home earnings are from investing directly in the stock market through SPY. Over the the course of 10 years, we assume the S&P 500 grows at 9% and has a 2% dividend yield. This means that over the course of 10 years, Joe will receive roughly $30,000 in dividends that he will have to pay taxes on each year. Since we assume that the S&P 500 appreciates by 9% a year, at the end of 10 years the $100,000 invested in SPY will be worth $236,000. At that time if Joe sells his holdings of SPY, he will have to pay capital gains taxes on the price appreciation. So what does the total tax bill (taxes on dividends + price appreciation) come out to? We assume the dividends are taxed at 32% in each year, and the price appreciation is taxed at 15%, which makes the total tax bill come out to $30,000. This means that after 10 years, Joe’s take-home gains are $136,000.

Now, let’s compare that number to if Joe had used a variable annuity to purchase $100,000 in SPY. The key differences are that the variable annuity will cost 0.52% a year, which will be a drag on the price appreciation, and that no taxes will be paid until the 10 years are up. At the end of the term, Joe will have to pay ordinary income tax rates on the growth of his $100,000. Assuming that Joe’s tax rate is at 32% after the 10 years are up, we calculate that Joe’s take home gains are $105,000. That about $30,000 less than if he had just bought SPY in his brokerage account.

What’s driving the dramatic difference between these situations? There are two reasons: the 0.52% fee on the variable annuity and the fact that the price appreciation in the annuity is taxed at ordinary income instead of the lower capital gains rate. Result: Deferring taxes is worse for Joe

Scenario #2: Tax Rate Drops in Retirement

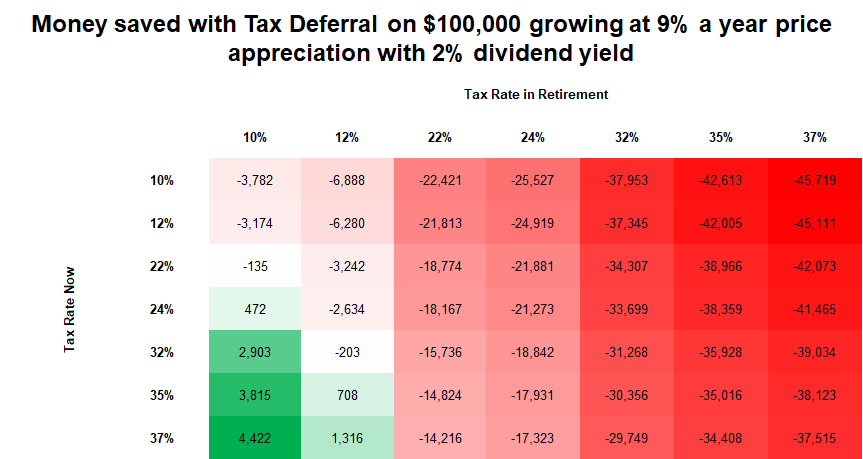

Scenario 2 is the same as Scenario 1, except that we assume Joe’s tax rate drops to 12% in year 10 when he retires. In this scenario, the amount of ordinary income taxes Joe pays would go down to 12% from 32%. However, even after this large drop in the tax rate, the take home earnings for Joe on his $100,000 investment is $136,000. That is about how much he would have made if he had just bought SPY in his brokerage account. This scenario highlights how big a factor the 0.52% fee on the variable annuity and the difference between the capital gains and ordinary income tax rate is. Even if Joe’s ordinary income tax rate drops to under half of his pre-retirement tax rate, its hard for him to break even on tax deferral because of the fee drag and because of how low long term capital gains taxes are relative to ordinary income taxes. A bigger question that we’ll ask is: is there a post retirement tax rate where tax deferral is actually beneficial for Joe? The table below shows the savings/loss from tax deferral in different pre-retirement and post-retirement tax scenarios.

The table shows a stunning finding: its extremely difficult to find pre-tax scenarios where a tax deferred equity investment saves Joe money relative to a non tax deferred investment. The green cells represent tax scenarios where Joe saves money, while the red cells are scenarios where Joe loses money. The lesson is that it may not make sense to use a tax deferred annuity solely for the purpose of buying and holding stocks over a long period of time. Annuities may provide other benefits, such as the ability to protect your gains in the market and to receive a guaranteed monthly income, but the math behind using them solely for the purpose of tax deferral for holding equities over the long term is tough. Result: Joe is indifferent about deferring taxes

Conclusion

The conclusion and lessons from our analysis is straightforward:

- If you own a fixed income instrument (e.g CD, bond, etc) that is not tax efficient, it is possible to save money using tax deferral if your tax rate is lower in retirement than it is now.

- If you own instruments such equity ETFs and hold them for a long period of time without trading them, it is hard to find scenarios where tax deferral using a variable annuity saves you money. The combination of fees and the difference between the ordinary income and capital gains tax rate is a large hurdle to overcome.