For many Americans, reaching retirement age doesn’t mean the end of work. That may be truer than ever for people in their 50s and 60s given the recent market slide related to the coronavirus pandemic.

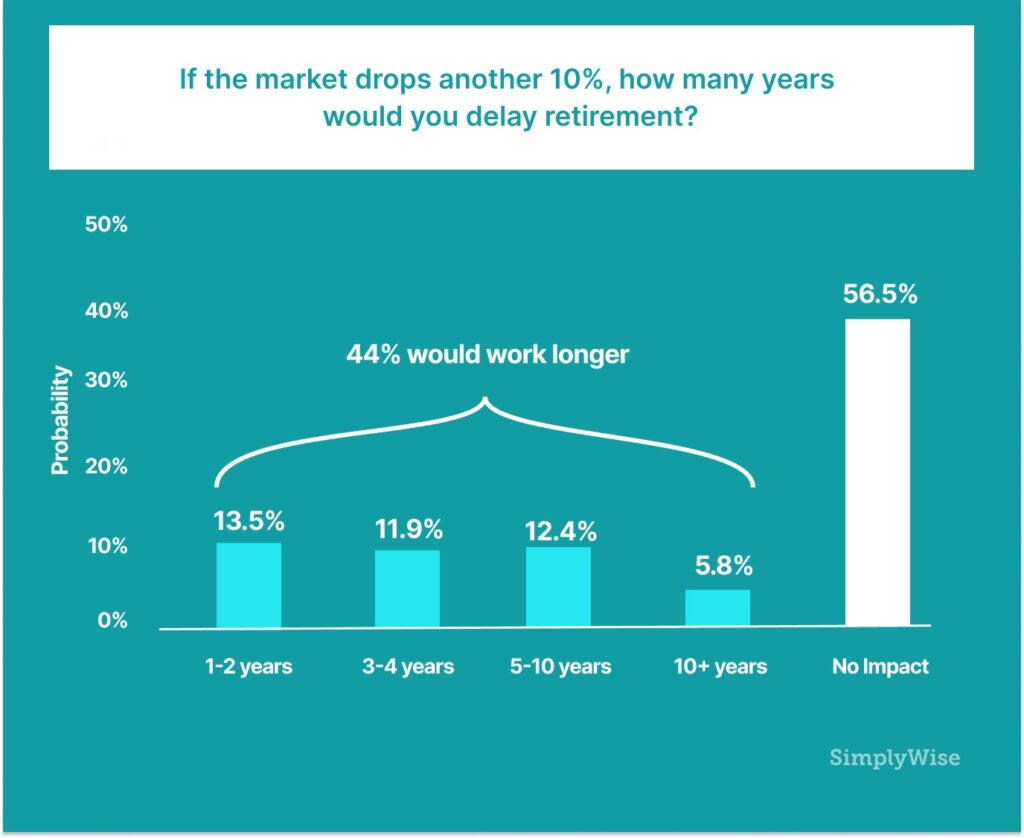

A survey conducted by SimplyWise on March 3 and 4 of people aged 55 to 60 found that continued market drops would potentially have a profound impact on the way they view retirement and the economy at large. Those drops have occurred this week. That means 44% of survey respondents who said they would delay their retirement, including 18% that would work for at least five more years as a result of the market drop, may now be seriously contemplating that future.

Stock market downturn and work

Of course, for many American workers, that was already the plan, regardless of stock market changes. In a poll from The Associated Press-NORC Center for Public Affairs Research, 23% of workers said they don’t expect to stop working. Additionally, new stats show that people above the age of 65 are already working at all-time highs since record keeping began.

If you’re among those concerned about your retirement years, and what a prolonged market downturn might mean for your retirement assets, there’s some good news.

Today’s older Americans are the healthiest generation of seniors in history, meaning they can and often want to work. The trend of working well after age 65 is boosted by the fact that today’s seniors have better, more flexible and more fulfilling work options at their disposal through recent technological advances. In fact, new stats show that people above the age of 65 are already working at all-time highs since record keeping began. Projections from the U.S. Bureau of Labor Statistics suggest this trend is not stopping anytime soon.

Here’s what our survey respondents had to say:

44% of respondents reported that they would continue to work longer as a result of prolonged stock market woes.

Of those who said they would stay in the workforce, more than 1-in-3 responded that it would be for at least five years. On average, those putting off retirement would work 4.9 additional years.

Does this make sense?

Everyone’s case is different, but for those who are capable of working and who feel the pressure from a reduction in savings, working more is a logical response.

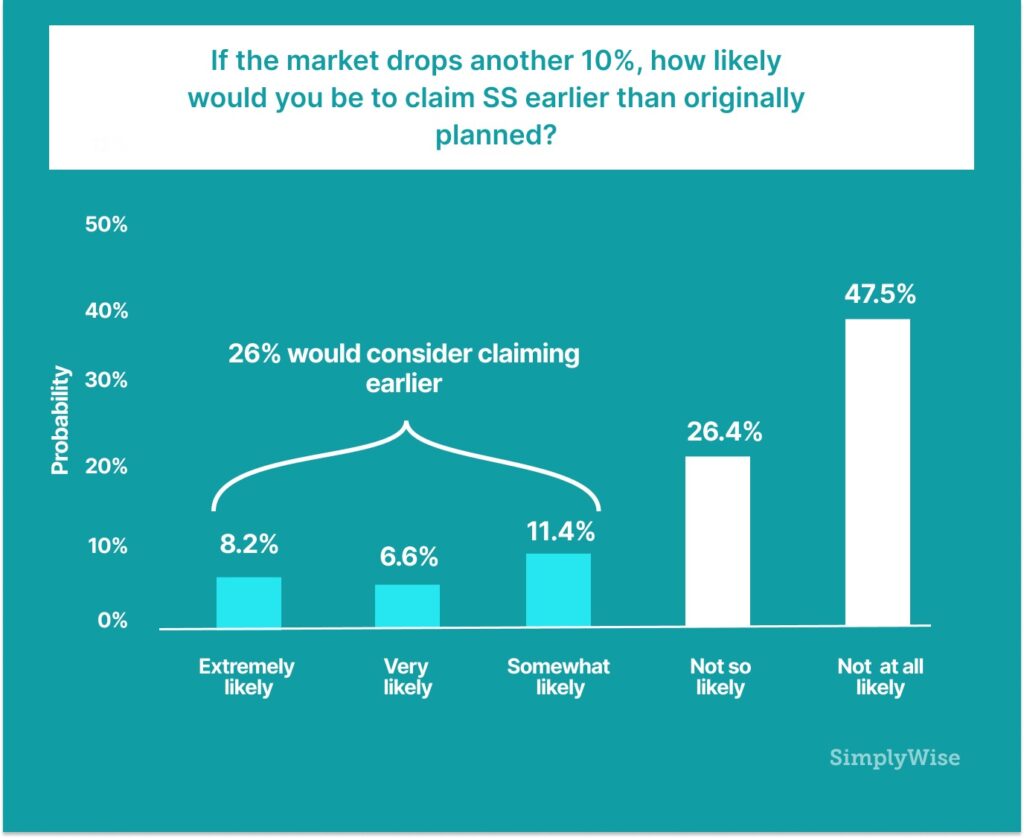

Stock market downturn and Social Security

Working longer isn’t the only adjustment that Americans are considering as a response to a more prolonged stock market drought. According to the study, more than 1-in-4 Americans are considering moving up the date at which they collect Social Security. This is even more significant when considering that around 1-in-3 Americans already claims Social Security at this earliest possible date.

Below, the full data:

Does this make sense?

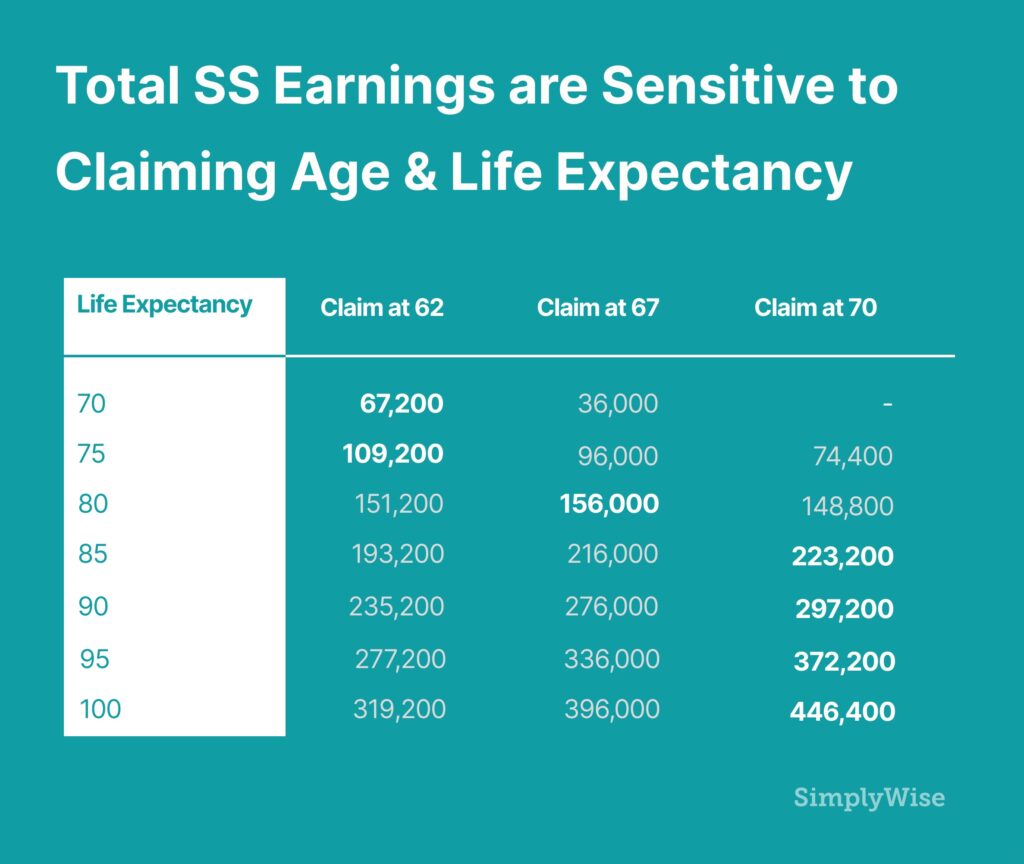

This decision is very case-specific, but we would generally caution around enacting this as a strategic response to a stock market decline (and a subsequent decline in savings). Social Security monthly benefit amounts increase 5-8% for every year you wait to claim from the time you turn 62 until you turn 70. The main legitimate reasons to take Social Security early are for those who cannot meet their monthly obligations otherwise and/or those whose life expectancies dictate that they would maximize total benefits by claiming earlier.

The following table shows how someone whose Social Security benefit at full retirement age of 67 is $1,000 would accumulate total income based on claiming age and life expectancy:

However, we view it unlikely that a 10% stock market dip is likely to materially affect either of these motives. While it may have some impact on savings and the ability to meet monthly obligations, most Americans at age 55 to 60 have investment portfolios weighted strongly to fixed income. In our survey, the average respondent is allocating 33% of their savings to stocks; this would result in a roughly 3.3% hit to savings.

One exception is for those who believe they have excellent investment opportunities. If you believe that you will earn greater than 8% annually on investments, it would make sense for you to collect Social Security earlier. In this case, your return will outweigh the return that the SSA will give you for waiting. Nonetheless, if you can, working longer is probably the better option.

Stock market downturn and desperation

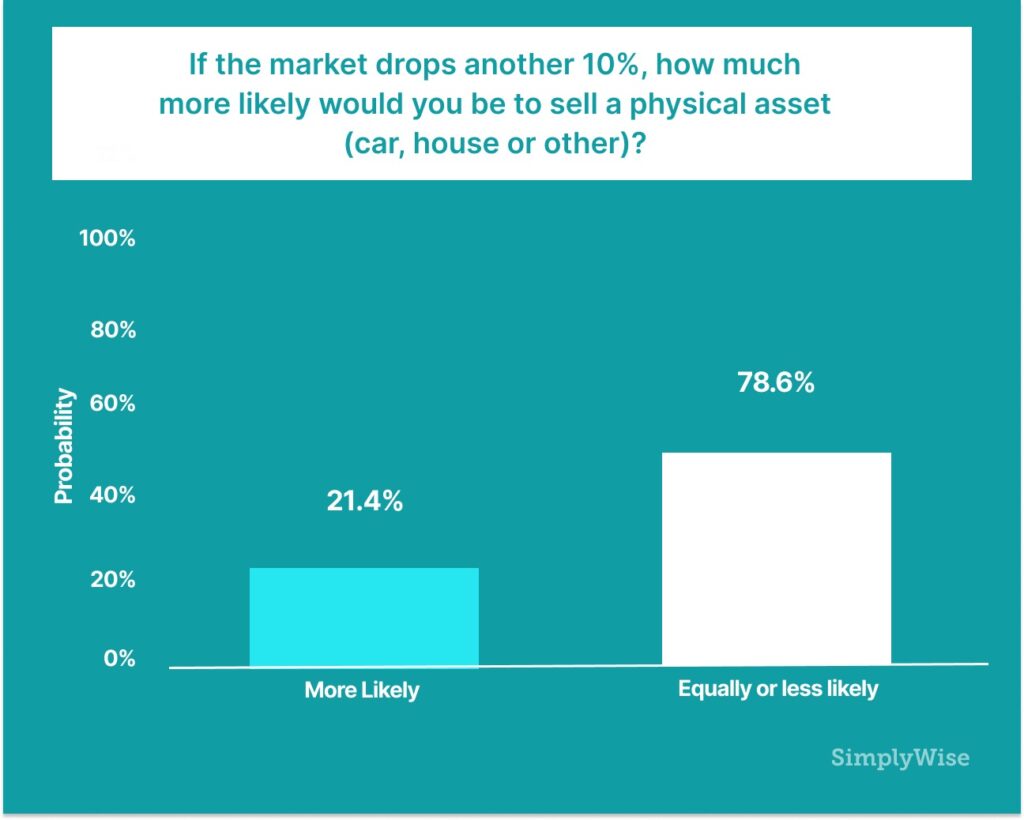

Perhaps the most grave indication that respondents gave was that nearly one in four claimed they would be more likely to sell their house, car or another physical asset during their retirement as a result of more stock market stress.

Does this make sense?

It may, although proceed with caution. For those with specific financial goals and a timeline around them (for instance, paying for a child or grandchild’s education), this may be the only alternative after seeing a downward shock in savings. However, make sure this is truly necessary. If not, you may find yourself selling into a down market and receiving less than is market value.

What you can do

As mentioned above, the most common solution — and the most advisable — to more stock market pressure is to remain in the workforce. Luckily for Americans about to enter their 60s, employers are looking upon older workers in a very favorable light, with current unemployment for seniors at 3.2%, compared to overall unemployment at 3.5%. We recently highlighted some of the fastest growing jobs for seniors.

While we don’t necessarily recommend taking Social Security earlier, it’s as good a time as ever to look into how to maximize your Social Security benefits. This means understanding and calculating what your options are for earned benefits, spousal benefits and survivor benefits, and analyzing how different factors in your life (your plans to work, your life expectancy, your short-term financial needs) may impact your decision. One of the best ways to do all that is through online Social Security calculators (we believe ours is the best).

For decisions on what to do with your assets and savings, it’s best to consider your options and if you can, consult with a financial professional to ensure that you aren’t exposed to more stock market risk than you are truly comfortable with. That way, you can mitigate the impact of stock market shocks.