Making a mistake on your taxes can not only be costly, it can be a big red flag for the Internal Revenue Service, leading to an audit. For people nearing retirement, the stakes can be even higher.

Many Americans in retirement will experience many “firsts,” including making retirement distributions, collecting Social Security retirement benefits and passing money to other family members. Additionally, they can increasingly become targets for scammers. While filing for 2019 is important, people approaching retirement need to look ahead and prepare themselves for the future.

We examined the most common and costly tax mistakes Americans make in their retirement. To do this, we enlisted the help of Jon Curry-Edwards, a principal at Friedman LLP and leader of the firm’s Private Client Tax Services Team. We put together a list of four of the most painful misunderstandings, as well as how to avoid them.

1. Underwithholding on retirement distributions

The problem: During their careers, many Americans become accustomed to taxes being automatically withheld by their place of work, and come tax time, they expect to be squared away or even owed a tax refund. However, with income sources changing in retirement, oftentimes federal and state tax withholdings from retirement distributions are not enough to cover a person’s tax liability. Further adding to the shortfall is that investment income (e.g., interest, dividends, capital gains) and Social Security benefits usually have no tax withheld.

How it hurts: If your withholdings are not enough to cover your tax liability, that means that you will owe the government the difference. If you haven’t planned for this and don’t have the money lying around, it could put you in a pinch and disrupt your financial life.

Advice from Jon: “Work with your accountant and financial advisor to prepare a tax projection so you can estimate what your tax liability will be and whether you’ll be underwithheld for the year. If so, you can increase your tax withholdings from your retirement distributions or make quarterly estimated tax payments.”

2. Assuming Social Security benefits are not taxable

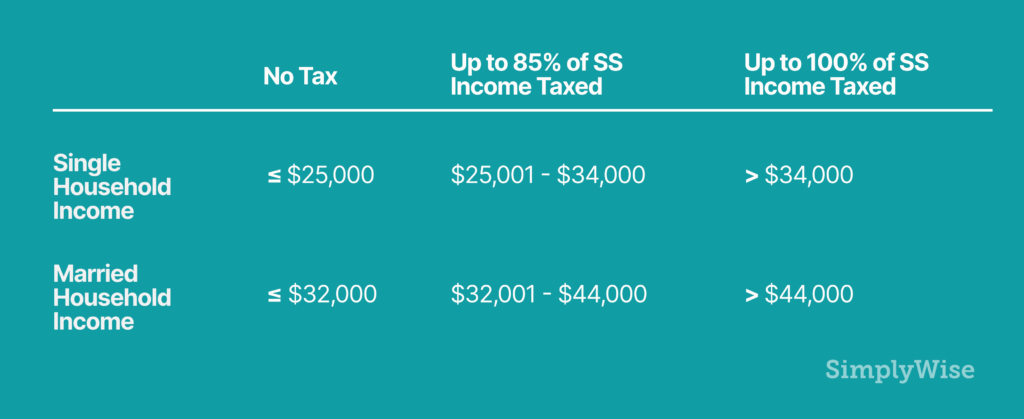

The problem: Many Americans mistakenly believe that Social Security is not taxable. While some will not pay taxes on Social Security income, singles with combined income over $34,000 and married couples filing a joint return with combined income over $44,000 could be taxed on up to 85% of their benefits.

How it hurts: Similar to underwithholding, not knowing the rules around Social Security and taxes could cause pain around tax season. Additionally, misjudging the tax implications could cause critical errors in longer-term planning.

Advice from Jon: Save a portion of your social security check to put towards taxes.

3. Missing changes to retirement distributions passed in the SECURE Act

The problem: Many Americans may not be aware that the SECURE Act was passed in December 2019, changing key elements of retirement distributions. For individuals born after June 30, 1949, the age for starting required minimum distributions was raised to 72 from 70-and-one-half. Also, many designated beneficiaries of retirement plans will now be required to take distributions over 10 years, replacing the more taxpayer-friendly life expectancy payout rules.

How it hurts: Certain designated beneficiaries, like adult children or grandchildren, receiving inherited IRAs will most likely pay more tax since distributions must be paid out within 10 years and, therefore, can be much larger when compared to distributions paid out under the old life expectancy payout rules.

Advice from Jon: Work with your accountant and financial advisor to get a handle on how the SECURE Act changes impact your planning. It may be beneficial to change your beneficiary to someone in the Eligible Designated Beneficiary definition since he or she will still benefit from a life expectancy payout. Even if you decide to not make any changes, it’s better to understand the tax consequences now and not be surprised down the road.

4. Falling into scams

The problem: Scammers often target retirees by pretending to be the IRS. A typical scam may include a scammer either telling a taxpayer that they owe money and demanding an immediate payment, or a scammer claiming that a taxpayer is due a refund and using that as an excuse to ask for bank account information.

(Seniors also need to be on the lookout for Social Security scams).

How it hurts: Falling into a scam will cost you money and time and can be a gigantic headache.

Advice from Jon: The IRS prefers to correspond with taxpayers through written communication like notices, so if a stranger calls claiming to be an IRS agent you should immediately be suspicious. Don’t provide personal information or bank account or credit card details to anyone you don’t know over the phone. The IRS will not call to demand immediate payment of a balance due or ask for debit or credit card numbers over the phone. Check the IRS website for more information on potential scammers.

Preparing yourself

No one likes surprises when it comes to their taxes. Keep these common mistakes in mind and be proactive to plan for your retirement years. Working with an accountant can be a big help in managing your tax liability and cash-flow expectations.

Moreover, getting ready for retirement is a process that includes understanding and maximizing Social Security income (earned, spousal and widow’s benefits), considering work opportunities, managing investments and a broad range of other financial and tax planning. The best way to do this is to start early, and there are plenty of resources online, including free Social Security benefits calculators, to help you do so.