Coronavirus has affected almost every part of our everyday lives – but one, in particular, is critically important for millions of Americans: Social Security.

The crisis and uncertainty has already impacted the 61 million Americans collecting Social Security benefits today. For example, Social Security offices are closed and scam callers with supposed ‘news about your benefits’ are on the rise. But as the crisis continues, things could also drastically change what Social Security looks like for future beneficiaries.

In these uncertain times, we outline the most important things you need to know about Social Security today–and for the future.

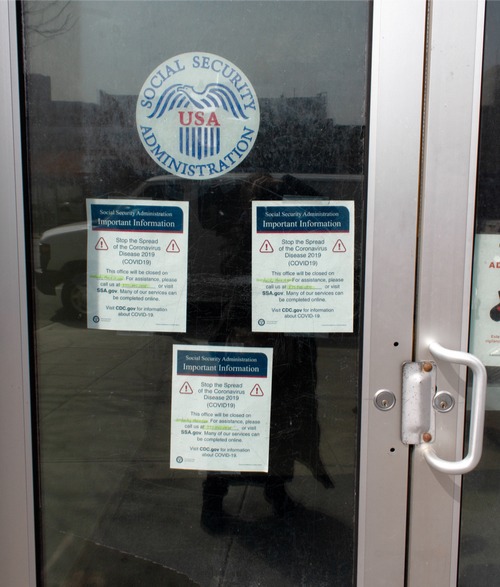

#1 Social Security Field Offices are closed

All local Social Security offices have been closed due to COVID-19 since March 17, 2020. The decision is meant to protect both Social Security Administration (SSA) employees as well as the many vulnerable individuals the SSA serves.

With offices closed, applications may now take longer to process. The SSA is prioritizing all critical requests, so delays for more “routine” cases are subject to occur. On average, it can take up to 6 weeks to process requests before any benefits are received.

Additionally, due to the closures, Social Security is not looking at medical continuing disability reviews right now. Once offices are open, only then will field offices follow up on medical evidence. This goes for any new hearings as well. All hearings for citizens that do not have current benefits will be processed as well. You can find more information on COVID-19 and its impact on the SSA here.

The SSA is requesting that individuals who need to get in touch first try to use their online services before calling, as wait times on the phone can be up to several hours. If you are looking to calculate or understand your potential benefits, you can skip the phone wait times by using an online Social Security calculator. But if in the end you cannot find the information you need online, you can also find a number and information on your local Social Security office here:

#2 The Social Security Cost-of-Living-Adjustment may be lower in 2021

To counteract rising prices of consumer goods, the SSA makes an increase called a cost-of-living-adjustment (COLA) to the amount it pays to beneficiaries of Social Security and Supplemental Security Income (SSI). Without COLA, people on a fixed income could eventually find themselves short of meeting their basic monthly expenses. If the average monthly benefit is $1,469 in January of 2020, after COLA, the payment is $1,503.

However, due to the pandemic, experts believe that the Social Security COLA for 2021 will be reduced significantly. COLA is calculated based on the Consumer Price Index, which highly weights the average value of essential goods, such as gasoline. Given that gasoline prices have plunged amidst the crisis, COLA can expect to be reduced as well.

Retirees received a 1.6% COLA adjustment for their benefits in 2020–which was lower than the 2019 COLA of 2.8%. And now, the Senior Citizens League predicts that the 2021 COLA could be around just 0.8% percent. This would be the lowest adjustment since 2017, when the COLA was 0.3%. However, it would be better than the zero COLA retirees faced in 2010, 2011 and 2016.

Any decrease in COLA adversely affects benefits, especially for older retirees whose portfolios will have shrunk and who rely more heavily on their Social Security benefits. However, the one bright spot, at least for lower income Americans, is that any lowering of the adjustment would trigger the “hold harmless provision.” This provision protects Americans below certain household income levels from having their Medicare Part B premiums go up by more than the COLA adjustment.

Either way, we will have to wait until October 2020 for the official 2021 Social Security COLA to be announced.

#3 Social Security scams are on the rise

The uncertainty caused by the pandemic has given way to a dramatic increase in reports of scammers and cyberattacks. The Federal Trade Commission reported a four-time increase in identity fraud in April 2020, compared to earlier this year. These fraudsters pretend to be government agencies, such as Social Security or the IRS. These scams–including stimulus check fraud–rank among the top consumer phone complaints.

The IRS warns of a new wave of hackers and has released guidelines to understand how to avoid these scams. Additionally, hackers have designed legitimate-looking sites to apply for stimulus checks. Some of these sites claim to speed the process of receiving your checks, especially because some Americans might not receive their checks for weeks, maybe even months.

Remember: never give out your Social Security number or banking information by phone to anyone who you did not call. Moreover, there is no payment that you need to make or personal information you need to share in order to receive your stimulus check. Social Security benefits have not been halted due to coronavirus, and the Social Security Administration has said they are committed to maintaining regular benefits payments throughout the pandemic.

#4 Your Social Security benefits could be taxed

Individuals who participate in retirement plans or own an IRA are typically mandated by tax rules to take a required minimum distribution (RMD) from their retirement plan, starting April 1 of the year they turn 70 ½. However, the CARES Act temporarily waives those RMDs throughout 2020. So anyone who has already begun taking RMDs, or who was required to begin taking them in 2020, will now have their RMDs waived for the remainder of this year. Therefore, people will not be forced to liquidate their investment accounts at a time of market volatility.

However, if retirees do decide to tap their retirement account for emergency cash right now, their Social Security benefits could be taxed at a higher level.

For individuals with a combined income between $25,000-$34,000, 50% of their Social Security benefit will be taxed. And if that income exceeds $34,000, 85% of their Social Security income could be taxable. For couples with a combined income between $32,000-$42,000, 50% of their Social Security benefit will be taxed. And if that income exceeds $44,000, up to 85% could be taxed.

As you think about tapping savings for emergency money right now, it’s important to watch out for these limits.

#5 Longer term, the Social Security trust fund could be affected

Pre-pandemic, the trustees from the Social Security Administration estimated that the trust funds will be depleted by 2035. This means they would only be able to pay a portion of the benefits Americans are owed, as tax revenue allows.

However, the pandemic and ensuing economic crisis could speed up that shortfall. Social Security’s coffers depend upon workers’ payroll taxes pumping money into the system. WIth unemployment expected to have spiked to a record 20%, that funding is taking a hit. And if unemployment continues, many will make the decision to retire and collect Social Security benefits early. Moreover, the recent CARES Act allows companies to delay Social Security payouts for up to two years. And while this doesn’t affect current beneficiaries, it highlights the pandemic’s impact on an increasing Social Security funding deficit.

What exactly is the effect of a depleted Social Security trust fund? Well Americans could face up to a 20% cut in their future benefits, and hospitals would not receive healthcare aid for senior citizens. This gives Congress a couple of options for the future of Social Security. For example, they could increase the age to receive benefits and increase the current payroll taxes that employees pay into. Social Security and its role in retirement planning may change. It’s important to stay up to date on any potential changes and what they could mean for your future finances.

Takeaways

With today’s uncertainty, it’s understandable to feel overwhelmed when it comes to thinking about the future. But as the COVID-19 pandemic has impacted the way we live our day-to-day lives, the way we think about Social Security and its place in our retirement is also having to shift. But to ensure your retirement and your personal security is protected, it’s now more important than ever to understand the changes happening with the SSA and what it means for your retirement.

Today, Social Security is operating at full capacity (despite SSA employees largely working from their homes) and the pandemic has not affected the typical dispersal of benefits. But if things continue, and as the SSA’s funds dwindle, the structure of Social Security payments could change dramatically.

For those currently on Social Security benefits, ensure you use trusted sources to get information about field office closings and re-openings, as well as any changes to benefits. Beware any fraudsters who may call with information about your stimulus check or Social Security benefits. When in doubt, hang up. And if you do decide to tap a retirement account, ensure you are educated about the tax implications.

For those eligible but not yet on Social Security – while we don’t necessarily recommend taking benefits earlier – this is a good time to consider how to maximize your benefits. That means understanding and calculating what your options are for earned benefits, spousal benefits and survivor benefits. One of the best ways to see what you’re owed is to use an online Social Security calculator.

Finally, for everyone today, remember to stay positive and take care of yourself. This time at home is the perfect moment to educate yourself about your Social Security options and plan for your future. Staying informed, aware, and empathetic is critical to making it through the crisis and keeping your financial life on track.