November 2020

With a politically polarized nation and COVID-19 cases surging around the country, uncertainty has become the new normal in America. While jobless claims have recently dipped slightly, the unemployment rate and 11 million jobless workers reported in October are both approximately twice pre-COVID levels. A majority of citizens remain paycheck to paycheck, unable to last even three months off of their savings. And of course, the gap in saving is even more dramatic when it comes to retirement. Particularly for older Americans, the pandemic has upended retirement plans and longtime savings.

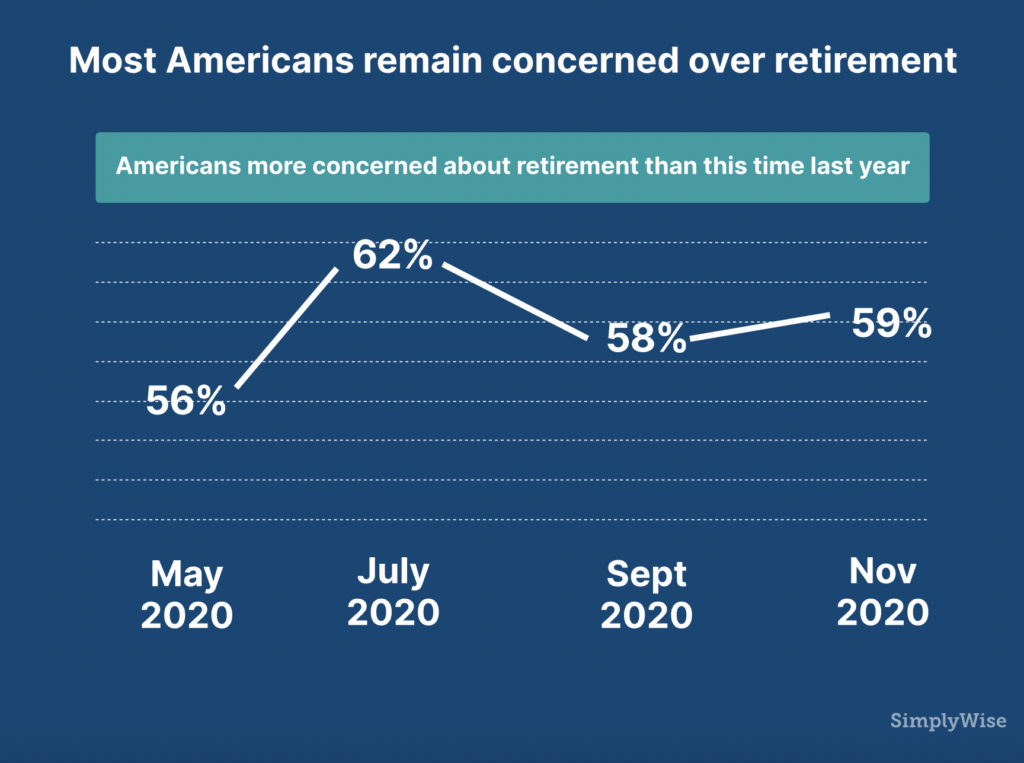

The bi-monthly SimplyWise Retirement Confidence Index has tracked sentiment regarding retirement and savings over the course of the pandemic. Now in its fourth iteration, the survey continues to find that a majority of Americans (59%) are more concerned about retirement today compared to a year ago. The latest Index polled 1,090 Americans ages 18+ between November 8-10, 2020. The survey explored how citizens are approaching savings, Social Security, and retirement, especially given the recent election and worsening situation around COVID-19.

Key Findings

- 71% of Americans aged 70+ are concerned about Social Security drying up – up from 29% in July and 54% in September.

- 43% of Social Security beneficiaries now worry about outliving their savings in retirement.

- 47% of Americans experienced an attempted Social Security scam in the last 3 months.

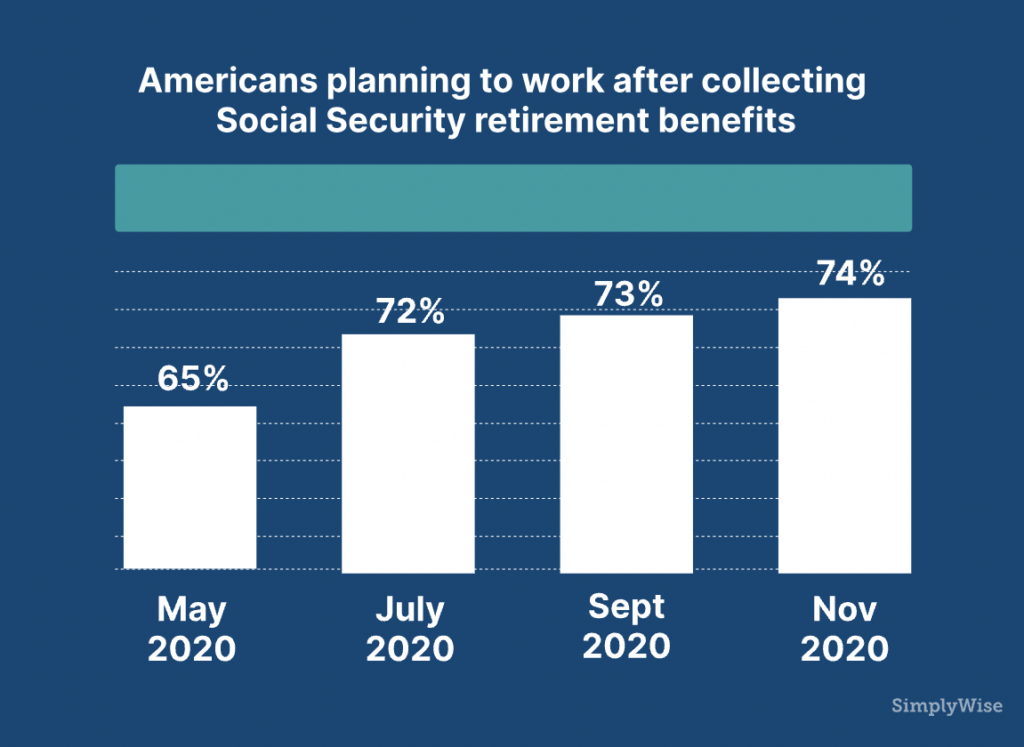

- 74% of workers now plan to work in retirement (up from 65% in May) – a pandemic high.

- 19% of people in their 50s now plan to work full-time in retirement (over double the reported 8% in May).

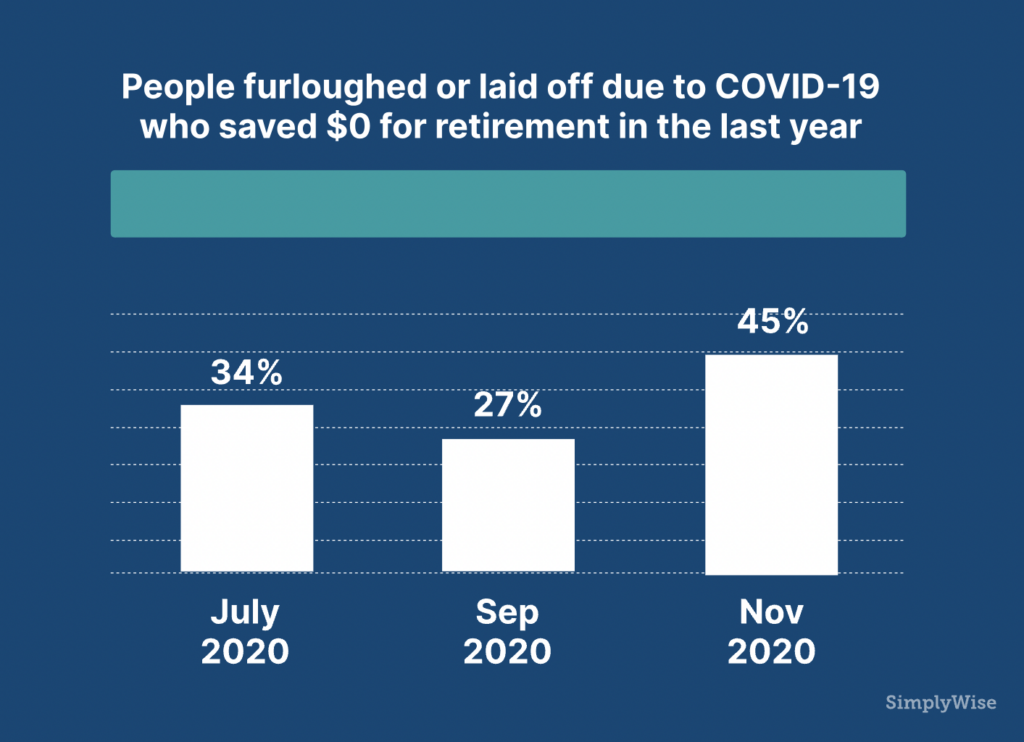

- Nearly half of people laid off or furloughed due to COVID-19 saved $0 for retirement in the last year – up from 27% in September.

- 29% of 401k holders are now planning to withdraw early from that account to pay the bills – a pandemic high.

- 34% of Americans are now planning to change their investment strategy to keep more in cash accounts.

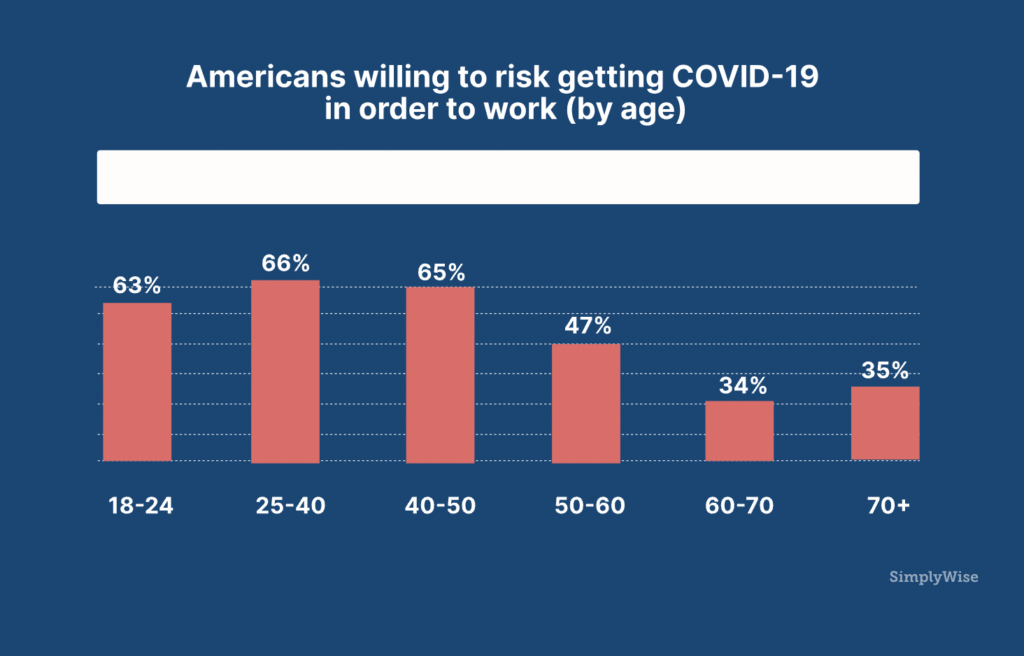

- 56% of Americans are willing to risk getting COVID in order to work, including 35% of seniors (60+).

- 94% of Democrats vs. 63% of Republicans are willing to follow a national mask mandate if instituted.

Majority of Americans concerned about retirement

Since beginning to measure retirement sentiment in May 2020, the SimplyWise Index has found that confidence remains low though unchanged. When asked how they feel about their retirement today compared to this time last year, 59% of Americans say they are more concerned now. This is compared to 56% in May, 62% in July, and 58% in September.

For those not yet claiming Social Security benefits, financial concerns are among the highest anxieties for retirement. Fifty-three percent worry about Social Security drying up, and 50% worry they will outlive their savings. Another 46% worry about paying medical bills, and 41% more generally worry about their ability to pay daily living expenses when they retire. Not to mention the uptick in social security related scams and the targeted fraud these Americans must be so vigilant against.

For Americans already claiming Social Security, 55% now worry about their benefits drying up—a significant increase from the 45% reported in May. A pandemic high of 43% of beneficiaries now worry about outliving their savings in retirement. That is up from 38% in May.

Similar to the results of the May, July and September 2020 Indices, the November Index found that 42% of American workers fear they will not be able to retire at all. For Americans in their 50s, who are nearing the legal retiring age, one in three worry they will not be able to retire. But that number remains highest for younger workers. Indeed, 46% of millennials today worry they will have to work for their whole lives.

State of work in retirement

COVID-19 has impacted the careers and finances of many Americans nearing retiring age. Of people in their 50s, 22% are now planning to postpone retirement from work, given the current economic climate. Of people in their 60s, 15% are now planning to postpone retirement. And of people in their 50s and 60s, 32% are now delaying Social Security retirement benefits. Those plans may be attributed to the fact that only 61% of workers in their 50s and 60s are making the same income they did prior to the pandemic.

At the same time, COVID-19 has pushed many others into early retirement, whether because of health concerns in going back to work; offerings of early retirement packages; or being let go. Of all those who lost their job or were furloughed in the pandemic, 10% are now planning to retire earlier than anticipated. For Americans in their 50s and 60s, one in ten are now planning to retire earlier than intended. And 13% in their 50s and 60s are now considering claiming Social Security retirement benefits early.

However, for many Americans, retiring from work does not necessarily mean stopping work altogether. The November Index found that 74% of workers today now plan to work after claiming Social Security retirement benefits. That is up from 67% in May, 72% in July, and 73% in September.

Of course, that percentage includes both people who plan to work full-time and those planning to work part-time. The vast majority of people who plan to work in retirement will work part-time. However, the November Index found that a pandemic high of 19% of people in their 50s now plan to work full-time after claiming retirement benefits. The May Index found less than half that number—just 8% of people in their 50s—plan to work full-time upon “retiring”.

Interestingly, for current Social Security retirement beneficiaries in their 60s and 70s, the numbers are lower, but not by much. In fact, the November Index found that 58% of beneficiaries in that age group are working full- or part-time. Of course, the majority plan to work-part time.

The number of seniors working in “retirement” is indeed high. However, the disconnect with the 74% who plan to work and the 58% of seniors in their 50s and 60s who are working in retirement could be due to a few factors. On one hand, it could be indicative of a changing trend. On the other hand, it could be yet another indicator of financial planning anxieties for retirement. Either way, it is reflective of that fact that many do in fact count on having their work income into their 60s and 70s. However, health issues or unexpected job losses (like many are facing today) can force people into early retirement. That is why, wherever possible, alternative savings or assets are critical for retirement.

State of savings

According to results of the November Index, 28% of Americans saved nothing for retirement in the last year. The results were similar to those of May, July and September, when an average one in three Americans saved $0 for retirement. Moreover, a majority (58%) saved under $1,000 for retirement in the last year.

The numbers were dramatically worse when it came to workers currently unemployed or furloughed due to the coronavirus. In fact, 45% of those Americans saved $0 for retirement in the last year, up from 36% in July and 43% in September. A full 41% of them could not last a month off of their savings. And 26% could not last even two weeks off their savings. Given that, for those who are longer-term unemployed due to the pandemic, benefits at both the state and federal levels are running out, another stimulus bill may be critical for this group.

The November survey also found that when it came to older populations, savings numbers became even worse. Financial advisors typically recommend saving the most for retirement in your 50s and early 60s. That is because there are special “catch up” periods for those age 50 or older where they can contribute beyond their retirement account’s usual annual contribution limit. However, the recent survey found that of Americans in their 50s, 27% saved $0 for retirement in the last year. And 42% could not last more than a month off their savings.

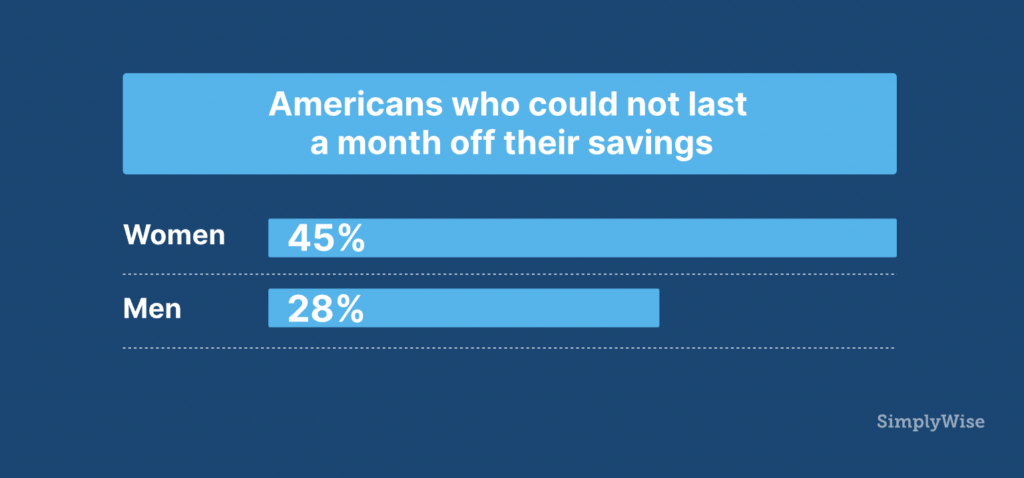

There was also a gender and racial divide in saving. When asked how long they could afford to not work and live off their savings, 38% of all Americans could not last a month. For men, however, 28% could not last a month, compared to 45% of women. For Hispanic and Black Americans, 47% and 46% respectively could not last a month on their savings. That is compared to 36% of White and 30% of Asian Americans.

And for those Americans who had previously saved, the “rainy day” for which many set aside emergency savings has arrived. A reported 14% of all respondents are now planning to withdraw what they have in emergency savings to pay the bills. For those let go or furloughed due to the coronavirus pandemic, 28% will withdraw from emergency savings.

Many Americans are also planning to dig into their retirement accounts to pay the bills. A total of 13% said they plan to tap their retirement savings. While financial advisors usually encourage those in their 50s to save at maximum levels to “catch up” on their retirement savings, our survey found that almost one in ten (9%) in that age group are instead withdrawing from those savings to cover their expenses today.

Even more are planning to specifically tap their 401(k). A pandemic high of 29% of 401(k) holders in November reported they are planning early withdrawal of those accounts. There was again a racial divide in plans to tap 401(k)s. Of Black Americans, an incredible 44% are now planning to withdraw, compared to 41% of Hispanic Americans and just 24% of White Americans.

For those laid off due to the coronavirus, 40% are considering tapping their 401(k). Current financial pressures have pushed these minority groups, who often have smaller nest eggs than White Americans, as well as recently laid off workers to need to deplete their future savings further.

The spike in numbers of people turning to these long-term savings accounts may be due to coronavirus-related legislation facilitating retirement withdrawals. Normally, withdrawing from your 401(k) or other retirement account before you are 59 ½ years old means a 10% penalty on the amount taken. The CARES Act, however, waives that 10% penalty on withdrawals up to $100,000 for distributions made to an individual throughout 2020. It may be that these individuals are looking to take advantage of this break before year end. However, it does essentially entail borrowing from your future self, as the cash you take out won’t have the opportunity to grow and compound over time.

Financial insecurity is a new normal

The pandemic has ravaged employment opportunities and savings for many Americans today. In fact, 43% of Americans would not be able to come up with $500 cash right now without selling something or taking out a loan. This number has stayed relatively flat across the Index, with approximately four in ten Americans unable to come up with that cash. Yet it greatly varies across racial lines. While 38% of White Americans could not come up with $500 cash, for Black and Hispanic Americans, 63% could not come up with that money.

That number is also worse for people whose jobs or income have been cut by the pandemic. While the unemployment rate has fallen in recent months, it remains well above pre-COVID-19 levels. For workers furloughed or let go due to COVID-19, 62% could not come up with $500 cash today. That is compared to 44% of people who currently work today that could not come up with that money.

Perhaps for this reason, many Americans are looking to other assets to pay the bills right now. For example, as in the May, July and September surveys, one in ten are now considering selling their home. In line with the previous Indices’ findings, another 10% are looking to refinance their mortgage. For Social Security beneficiaries, many of whom depend on their fixed income and retirement portfolios, a high of 17% are now considering selling their home given the economic climate. That is up from 11% reported in May. And 12% of beneficiaries are now considering refinancing their home.

This insecurity and, for many Americans, financial desperation, is causing some to take more “drastic” measures during the pandemic. Despite recent record-breaking coronavirus case numbers, 56% of Americans reported that they are wiling to risk getting COVID-19 in order to work. There was a divide between Democrats and Republicans on this measure, with 50% of Democrats versus 69% of Republicans responding that they would risk contracting the virus to go to work. When asked whether they would be willing to follow a national mask mandate if instituted, 94% of Democrats reported they would, compared to 63% of Republicans.

The sharpest divide in willingness to risk COVID to work, however, was amongst age groups. American seniors (age 60+) were comparatively the least likely to risk getting the virus to work compared to Americans in their 20s, 30s, 40s, and 50s. The findings are indicative of the impact of the virus on older Americans who are typically higher-risk and so may be less willing or able to return to the workplace. In the coming months, this could significantly alter peoples’ plans on when to begin claiming Social Security retirement benefits. At the same time, the 35% of seniors willing to risk COVID to go to work may be a further indicator of the financial anxiety many are feeling today.

Indeed, with the acceleration of coronavirus cases and new restrictions on business activity, the economic outlook is looking highly uncertain. The November Index found that Americans were almost exactly split in their perception of the economy, with 33% saying they believe it will get better in the next six months—and 31% saying they think it will get worse.

Again, there was a divide along party lines. Of Democrats, 46% believe the economy will get better, where exactly 46% of Republicans believe it will get worse. This is in stark contrast with the results from just two months ago. The September Index found that 43% of Democrats believed the economy would get worse, and 43% of Republicans believed it would get better. The dramatic flip has likely been influenced by the recent election results.

Across the board, however, the pandemic and the political environment has pushed many Americans to make big changes to their financial habits, including saving more, curbing spending, and generally re-evaluating their budget and priorities. This includes changing investment strategies and asset allocations. For example, the November survey found that 34% of Americans are now planning to keep more in cash accounts. (And of those planning to make any change to their investment strategy, over half will do so to build up more of a cash buffer.)

However, 28% of Americans are seeing an opportunity in the stock market, and are now planning to invest in equities. Democrats appear more bullish on stocks, with 34% planning to buy, versus just 21% of Republicans. In fact, Republicans surveyed were overall less optimistic about “risky” assets including equities and cryptocurrency. Indeed, one in five Republicans are now looking to buy gold. Of Democrats, 9% reported that they now plan to invest in cryptocurrency, compared to just 5% of Republicans.

Future of Social Security feels uncertain

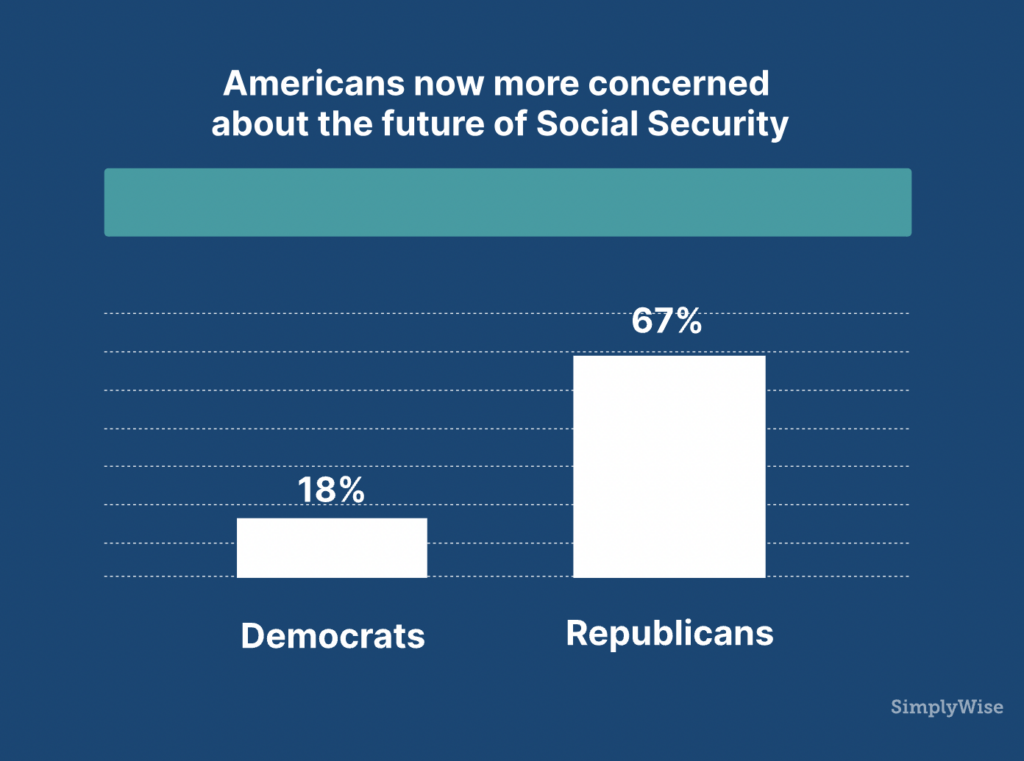

The uncertain economic outlook, largely divided along political lines, carries over into concern for the future of government programs. This is particularly true in the case of Social Security.

Even before the COVID-fueled national lockdown began, the Social Security Board of Trustees reported earlier this year that its funds would be depleted by 2035 given current spending levels. Of course, that did not mean that Social Security would end in 2035. Instead, it meant that its cash reserves would be gone, and it would only be able to dole out what it collects in taxes each year. According to the Trustees, that would mean that the Administration would only be able to pay beneficiaries 79% of the money they are owed.

Its reserves are running out due to demographic trends. The generation behind Baby Boomers, GenX, is much smaller than the Boomers swelling the ranks of retirement beneficiaries. This means that there are less workers paying in taxes to fund those benefits. So current tax revenues won’t cover benefits and Social Security will have to tap the surplus.

But the pandemic has accelerated the depletion of the program’s reserves. The tens of millions of Americans who have lost their jobs over the course of the pandemic have wiped out the payroll taxes that fund Social Security’s coffers. The longer they are out of a job, the deeper that deficit becomes.

The program’s fate is tied to both the length of the pandemic’s toll on the labor market, as well as the new policies of the next president and Congress . Yet with control of the Senate still undecided and worsening virus numbers, it can be hard to imagine what the future of Social Security and retirement look like.

For many, the November election results were concerning with regards to the future of the program. In fact, 42% of current Social Security beneficiaries reported feeling more concerned about the program’s future after the election. That is compared with 32% of Americans not yet claiming who report feeling more concerned now.

As with the economic outlook, results were divided by political party. Only 18% of Democrats reported feeling more concerned about the future of Social Security, compared with 67% of Republicans. Results were also split by age group, with Americans age 70+ among the most concerned. In fact, 71% of those age 70 or older reported they are now concerned Social Security will dry up during their retirement—up from 29% in July.

COVID-19 Social Security office closures

Note that with the confusion around the office closures and changing communication methods with the SSA, Social Security-related scams have escalated during the pandemic. In fact, the November Index found that an incredible 47% of Americans had experienced an attempted Social Security scam in the last three months. The numbers were worse for seniors; 53% experienced an attempted Social Security scam in the last three months. And 21% of seniors experienced more than three attempted Social Security scams in that time period.

Staying informed of existing and emerging scams is critical to protecting yourself against fraudsters. If you think you have been the attempted victim of such a scam, we recommend immediately reporting it to the Social Security Administration’s Office of the Inspector General.

Takeaways

Eight months after the COVID-19 pandemic first sent towns and cities across the U.S. into lockdown, the virus continues to transform the way we live, work and retire. Now with record case numbers and political division continuing to rock the nation, the economic outlook appears highly uncertain. While federal and state officials seek to ease the financial burden on citizens and businesses, many of the new government policies and regulations can be confusing to navigate.

That is especially true when it comes to Social Security, which has been hit hard by the pandemic. COVID-19 has forced the SSA to move most of its operations and communications online or by phone. The future of the program appears to be subject to both the length and severity of the pandemic, as well as critical policy decisions made by the next Congress and president. A majority of Americans rely on these retirement benefits for a significant portion of their income in retirement today. Fixing the deficit will be critical to ensuring these seniors’ benefits are not reduced during their lifetime.

Americans who are not yet retired but whose finances have been impacted by the pandemic can use this time to organize their finances. “You need to do what is right for your own personal financial situation today to get through these challenging times,” says SimplyWise CEO Sam Abbas. “But given the uncertainty, it’s more important than ever that when you’re back on your feet, you prioritize organizing your finances, building back emergency and retirement savings, and investing in the future.” By closely tracking and reconciling expenses, you can find areas to save in your current spending. Take the time to determine what you will need in retirement finances, and make any necessary adjustments to your savings and portfolio asset allocations. For those considering claiming Social Security, consider how you can maximize your benefits. A Social Security calculator can help determine any earned, spousal or survivor benefits for which you’re eligible.

While the COVID-19 pandemic continues to alter our lives, you can take control by educating yourself about your financial options to ensure your future planning remains on track.